Spousal RRSPs and Other Strategies

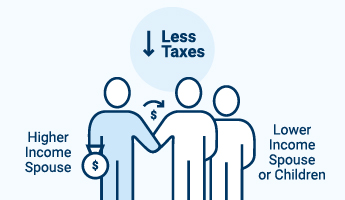

If you earn substantially more income than your spouse (or vice versa), an income splitting strategy may be a smart way to reduce your family’s tax bill.

Find a Financial Planner

Two Popular Income Splitting Strategies

Expense Funding Strategy

- The higher income spouse pays all household expenses

- The lower income spouse invests as much as possible of their own income

- With this strategy, the investment income will be taxed at the marginal rate of the lower income spouse

Spousal RRSP Strategy

- The higher income spouse contributes to the lower-income spouse’s RRSP

- The spouse making the contribution claims in on their tax return, reducing their taxable income

- The goal is to contribute until the planned retirement income of both spouses is about the same

Could You Be Paying Less Taxes As a Family?

Download our Income Splitting Checklist for strategies you may wish to consider in order to reduce your family’s overall income tax bill.

Before you download the checklist...

Are you interested in receiving complimentary financial advice?

Okay, thanks. Here's the checklist...

If you change your mind later, you can always contact us toll-free at 1-833-722-7526.

You Might Also Be Interested In

Should I Pay Down My Mortgage or Invest?

Talking Finances With My Spouse

What is Financial Planning?

RBC Financial Planning is a business name used by Royal Mutual Funds Inc. (RMFI). Financial planning services and investment advice are provided by RMFI. RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.