How Tying the Knot Affects Your Finances

With marriage comes great financial opportunities. A financial planner can help you and your spouse set a plan for the future, as a couple.

Talking Finances with My Spouse

While you might not always see eye to eye, you and your spouse can head in the same direction with a plan that works for both of you.

Financial Issues Facing Couples

Have different ideas than your significant other about spending, investing and borrowing? You’re not alone!

Here Are Few of the Challenges You May be Facing:

- One of you is a saver while the other likes to live for today.

- You can’t agree on where to live—your house, my house or a new house?

- You have a blended family with children from previous marriages.

- There are spousal support and child custody arrangements.

- You react differently to the market’s ups and downs.

Finding Common Ground

These differences with your spouse can usually be overcome with the right plan and a good financial planner. Talking to a financial planner about your current needs and future plans will go a long way toward getting on the same page with your spouse.

An RBC Financial Planner Can Help With:

- Strategies to build wealth

- Managing cash flow

- Retirement planning

- Borrowing and debt management

- Tax reduction strategies

- Estate Planning

It Pays to Have a Financial Planner

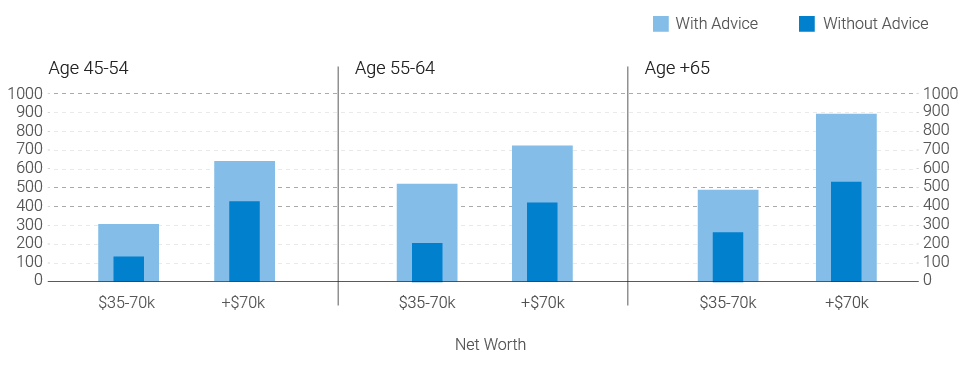

Studies show that households that receive financial advice have significantly greater net worth than those who don’t.1 So, take a vow to partner on finances!

You Might Also Be Interested In

Is Income Splitting Right for Us

Conversations to Have With Loved Ones

Talking Retirement With My Spouse