4 Questions to Ask Yourself

If the rate of return on your Registered Retirement Savings Plan (RRSP) is expected to be higher than the interest rate on your loan, borrowing to invest could put you ahead. But, if your RRSP rate of return is less than your loan rate, an RRSP loan may not be your best option.

The higher your current tax rate and the lower you expect your rate to be in the future, the more it may make sense to borrow to invest in an RRSP.

If you find it hard to save, borrowing might be a good solution to ensure you make your RRSP contributions.

You will have to repay the loan’s principal and interest even if the value of your investment goes down.

Example: No Loan vs. RRSP Loan

Sylvie

Investment: $300/month

Rates: Estimated rate of return is 6%, borrowing rate is 4% and marginal tax rate is 40%.

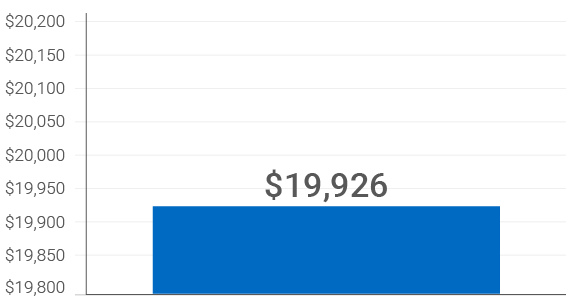

Scenario 1:

No loan. Invest $300 after-tax dollars per month in RRSP.

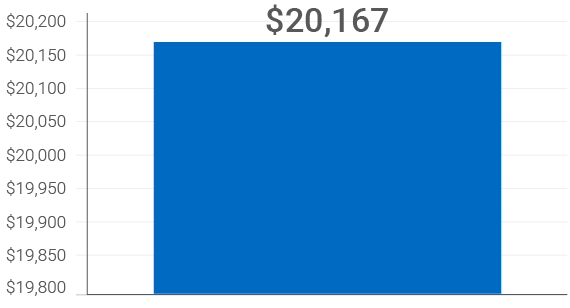

Scenario 2:

Borrow $16,933 to make an RRSP contribution.

- At the end of three years, Sylvie’s RRSP is worth $241 more by using an RRSP loan and making the same monthly payments.

- In another twenty years, this difference will grow to $798.

Could You Be Getting More Out of Your RRSP?

This guide reviews the basics of RRSP investing and outlines the strategies available to maximize your RRSP savings.

Before you download the guide...

Are you interested in receiving complimentary financial advice?

Okay, thanks. Here's the guide...

If you change your mind later, you can always contact us toll-free at 1-833-722-7526.

You Might Also Be Interested In

Getting More from My RRSP and TFSA

Reaching My Financial Goals Faster

Should I Change My Investment Plan?