Invest Regularly

Investing regularly, such as through an automatic savings plan, can help you stay on track over the long-term. See how your savings can add up1,+ :

| $50 per month | $100 per month | $250 per month | $500 per month | |

|---|---|---|---|---|

| Invested for 5 Years | $3,489 | $6,977 | $17,443 | $34,885 |

| Invested for 10 Years | $8,194 | $16,388 | $40,967 | $81,940 |

| Invested for 15 Years | $14,541 | $29,082 | $72,705 | $145,409 |

| Invested for 20 Years | $23,102 | $46,204 | $115,510 | $231,020 |

| Invested for 25 Years | $34,650 | $69,299 | $173,249 | $346,497 |

Invest Enough

Putting aside more money may seem like an obvious strategy, but sometimes it’s easier said than done. What if you aren’t sure where you can pull the money from to boost your contributions? An RBC Financial Planner can look at your entire financial picture—debt, cash flow, investments and more—to help answer that question.

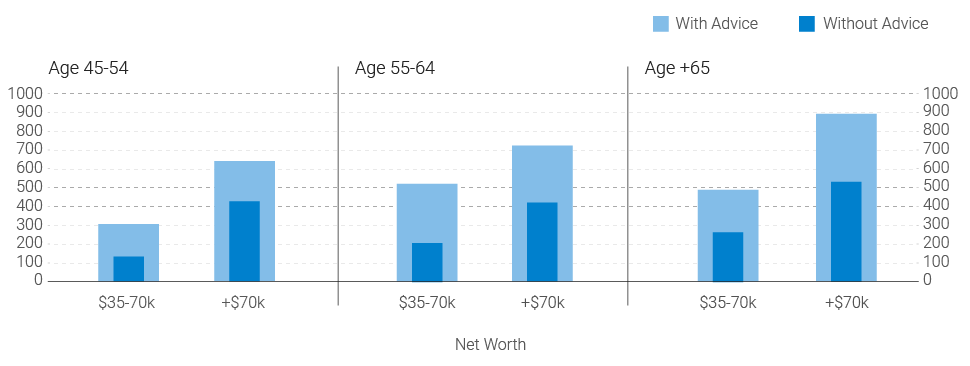

The Value of Advice

Research shows that Canadians working with advisors have more retirement savings than Canadians who are saving without the advice of an advisor.2 Studies also show that professional financial advice has the potential to help you double—or even triple—your net worth3—even after fees!

Could You Be Getting More Out of Your RRSP?

This guide reviews the basics of RRSP investing and outlines the strategies available to maximize your RRSP savings.

Before you download the guide...

Are you interested in receiving complimentary financial advice?

Okay, thanks. Here's the guide...

If you change your mind later, you can always contact us toll-free at 1-833-722-7526.

You Might Also Be Interested In

Minimizing U.S. Estate Tax

Talking Retirement With My Spouse

Reaching My Financial Goals Faster