The Rewards of Parenthood Are Priceless (But Also Expensive)

A financial planner can help you build a bright future for your child—while keeping your other goals in sight.

New Baby, New Financial Priorities

Babies are cute—but let’s face it, they’re expensive too. Your financial planner can help you manage your changing financial picture.

6 Ways a Financial Planner Can Help

Has your income taken a hit with parental leave? Your financial planner can give you advice on how to manage through tighter times and strategies for catching up after things settle down.

If you need to use credit to cover a reduction of income or the increased costs of parenthood, your financial planner can show you the best ways to borrow.

Whether you want to adjust your contributions or start investing in a Registered Education Savings Plan (RESP), your financial planner can revise your plan to accommodate your new priorities.

See What Kind of RESP Should I Choose?Your financial planner can make sure you’re using the right type of accounts for your savings goals, and that you’re making the most of income splitting and other tax-smart planning strategies that can help you minimize the tax you pay.

See Is Income Splitting Right for Us?When you have a new baby, it can be tempting to sacrifice saving for retirement, but you don’t have to do that. Your financial planner can show you how to balance all of your financial priorities.

See Retirement PlanningInsurance, creating/updating your Will and other estate planning strategies are all options you’ll want to consider.

See How Can I Protect My Children Financially?Get Your Family Off to a Great Start

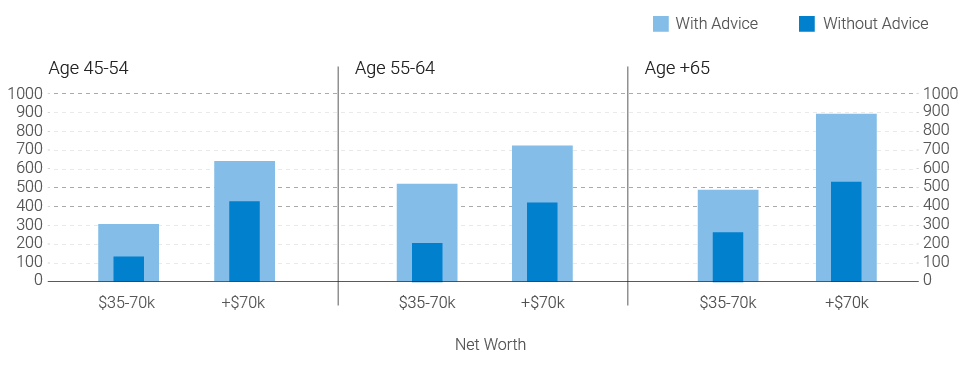

As shown below, households that receive financial advice have significantly greater net worth than those who don't.1

You Might Also Be Interested In

Talking Finances With My Spouse

Making the Most of a Bonus or Tax Refund

Estate Planning is More Than A Will